By Linda Massi

15 minute read

Linda Massi By Linda Massi

15 minute read

There are many perks of working in a fashion company: creativity, glamour, excitement. However, there is something else just as important to consider, budgeting. When making a garment, a lot of different people are involved and different interests are at play. You want your end product to be high quality and fairly priced, but you also need a profit in order to keep the brand going and be able to invest in the next season. If it sounds complicated, it’s because it is. But don’t panic, we’ve got you - here it is: the ultimate guide to garment costing and pricing.

The Ultimate Guide to Garment Costing and Pricing Strategy

- The different parts of the final price

- How to calculate garment pricing

- How to calculate garment costing

- The risk of using Excel

- How to come up with an apparel pricing strategy

Breaking down Garment Costing and Pricing

Talking basic economics, there are three components in a simple transaction: revenue, cost, and profit. Imagine buying an apple for 50c at the farmer’s market. Then you go home and sell it to your friend for 80c. Your revenue, which is how much you put in your pocket, is 80 cents, but your cost, which is how much you spent, is 50 cents. This means that your profit, which is how much you earned, is 30 cents.

Revenue - cost = profit

In the apparel industry, the revenue is the final price the customer will be paying. It could be the retail price if you sell directly to consumers, or the wholesale price if you sell to resellers. The cost needs to cover everything from development to distribution. Finally, your profit will be the margin — the difference between the two.

As you can see, pricing and costing are very tightly connected. It’s important to have a target margin, which describes how much you want to make for every product sold. This is fundamental, as it will let you know if your collection is viable or not.

Target margins vary depending on the industry and the company policies, and so do costs. What you need to keep in mind, it’s that both of them have to be covered by the final price of the product.

Garment Pricing

Let’s start at the end: the final price of your product. This is the number on the price tag and what the end consumer will pay. To come up with a target price, you need to know how much your consumer is willing to spend. In fact, creating products that are just too expensive for your target market is not a feasible option.

Define who your target customers are and take into account things like their income and the pricing of your competitors. Are you creating luxury products? Or affordable items for the everyday consumer? How much do you think you’re going to sell? All these things will influence your estimation of the final price.

Experienced companies are able to estimate the final price quite accurately because they have data from previous collections to build upon.

Example: a company knows that given its target market and selling quantities, the optimal final price for a t-shirt is €15. They know that to keep the business running, they need to make €8 for every t-shirt sold. €8 is their target margin. Therefore, their target cost is €7, that’s the maximum they can spend on producing a t-shirt.

15 - 7 = 8

Garment Costing

Apparel costing needs to keep track of a lot of different costs. Cost price is what you have to pay the supplier. Landed cost is the expense to have the product in your stock, including freight and transportation. Lastly, the retail and wholesale mark-ups cover costs like distribution and getting the product to the customer or the reseller.

Guide to Garment Costing:

Garment Costing: Cost Price

When your design is ready, it’s time to bring it to life.

First, you’ll need samples, which are usually the most expensive part of the production process. Before spending money on samples, investigate if the cost level the supplier is offering is within scope based on the estimated order quantities.

The sampling process will give you a more accurate picture of the cost price, which will change depending on the quantities of your order. Plan your collection and think about how many pieces you will sell of each item.

When working with a supplier, you can ask for a target cost price, which you’ll calculate based on the target sales price. Otherwise, you can let the supplier estimate a first price.

The target cost price is useful for both you and the supplier because it defines what you want from the start. Something to remember, about the target cost price, is that the supplier knows what you’re willing to pay, so they might charge you more. Second, always allow yourself a buffer for any extra charges that might come up. If your target cost price is €10, tell the supplier it’s €9, so you’re sure you won’t go over budget.

Here is a checklist of what factors influence the cost price:

Product Cost

Before looking for suppliers, decide whether you want to go CMT (Cut, Make, Trim) or Ready Made. The former implies providing the suppliers with materials and only covering the manufacturing costs. The latter means that the supplier will cover everything from fabric to manufacturing.

Product cost refers to the actual expense of your garment, and it’s based on the Bill of Materials (BOM). If you work CMT, then you will receive a costing table laying out:

- Fabric Cost, which covers all the different fabrics used

- Trim and Packaging cost, which includes everything from sewing thread to labels

- CMT (Cut, Make, Trim) which is the manufacturing cost

- Every additional cost such as screen printing or embroidery.

If you work with Ready Made cost prices, you will get one price including everything mentioned above.

Additional product costs

You might have additional product costs for using materials from sub-suppliers, parts from nominated suppliers, gift packaging that is charged separately, or supplier agent fees. Remember to add it to your supplier cost price.

MOQ

The cost price doesn’t depend only on product costs. As with most things, the more you produce, the cheaper it is. This is called economies of scale, and it’s why suppliers have a Minimum Order Quantity. MOQ doesn't refer to the style, but to fabric and color. This means that if you have more styles in the same materials, you could split the quantity between them, and produce more of one or the other according to your strategy.

Be aware of what the MOQ is and if you can meet it before deciding on a supplier, since it can lead to surcharges or discounts.

Surcharges are charges applied when the MOQ isn’t met. They can be as high as 50% of the cost of production. Keep in mind that if the quantity required is too small, the supplier might not produce, not even with a surcharge.

On the other hand, if you’re placing a big order, you might get a discount. Discounts aren’t as high as surcharges, they’re only around 5%, but they still influence the supplier cost price.

Currency

Deciding in which currency to trade is essential when negotiating with suppliers. In fact, you need to agree on a fixed exchange rate, which should include a bit of buffer. This is to cover the exchange risk — the possibility that one currency could change dramatically and throw off the cost of your garment. The higher the risk, the higher your buffer should be.

For example, let’s imagine your local currency is EUR and your supplier works with USD. Right now the exchange rate is 1 USD = 0,85 EUR. USD and EUR are stable currencies, so the buffer doesn’t need to be too high. Either way, you can agree with the supplier that 1 USD = 0,90 EUR, regardless of the exchange rate.

Payment terms

Payment terms don’t influence the cost price but are useful to minimize your risk and control your cash flow. Always remember to agree with your supplier on payment terms that are convenient for both of you.

Click here to learn more about different payment terms.

Delivery terms

Depending on your delivery terms, you might have to cover freight and transport costs, unless they are included in the supplier cost price. In both cases, delivery costs need to be added to the cost price.

Click here to learn more about different delivery terms.

Garment Costing: Landed Cost

Now that you have the supplier cost price, freight and tax need to be added in order to get to the landed cost.

Freight Rate

The freight rate refers to the price to deliver cargo from one place to another. It depends on the form and weight of the load, the mode of transport, and the distance traveled.

There are different ways to define the freight rate, which usually depends on the average cost for the product category.

Freight in %

Freight is calculated as a percentage of the supplier cost price. This is the most used way to estimate freight. The percentage will vary depending on how heavy the product is.

Example: 5% of supplier cost price.

Freight in currency

Freight is a fixed amount in currency.

Example: 1 EUR per piece.

Freight based on volume

Similar to freight in currency, but instead of being calculated on pieces, it is based on volume.

Example: 1 EUR per mq.

Freight insurance

Most companies include insurance in their freight cost but, depending on your terms of delivery, you might need to add it on top.

Tax rate

The tax rate depends on the country, the product category, and the quality of products. Remember to include tax in your calculation.

In some countries, if the good is exported right after it’s been imported, you can avoid paying tax on import. However, this is not very common and can only happen through a tax free warehouse facility.

You might ship directly to your customers’ country from the supplier. In that case, tax has to be paid in the third party country you’re shipping to.

Finally, your landed cost will be:

(Supplier cost price x Supplier currency exchange rate) x (1 + (Freight insurance %) x (1 + Freight %) x (1 + Tax Rate %)

Example:

- Supplier cost price: 10 USD

- Supplier currency exchange rate: 0,90

- Freight insurance: 1%

- Freight: 5%

- Tax rate: 12%

Landed cost in EUR = (10 USD x 0,90 (EUR/USD) x (1+ 0,01) x (1 + 0,05) x (1 + 0,12) = 10,69 EUR

Garment Costing: Wholesale & Retail Mark-Up

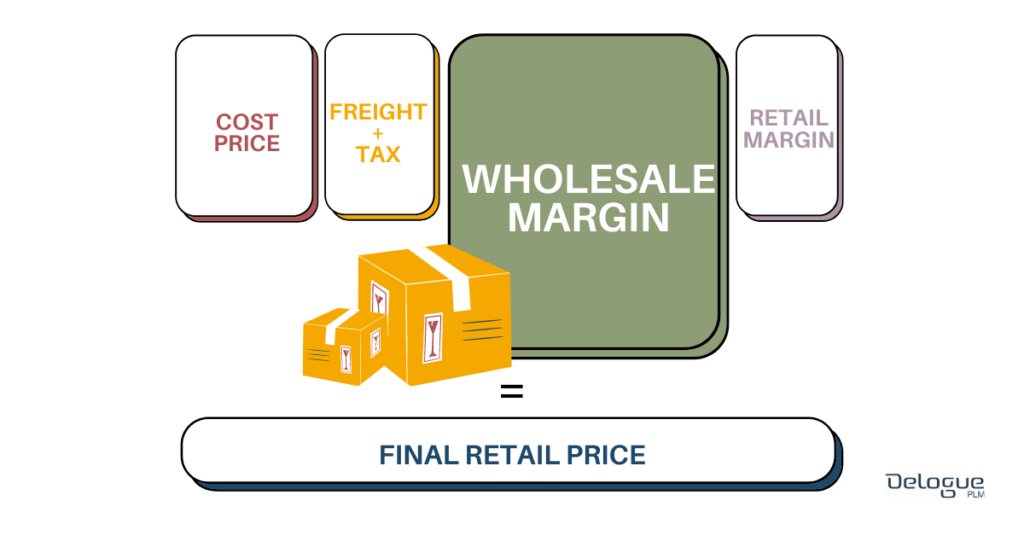

The products are in stock, now you need to sell them. Selling also involves some costs that will eat away at your margin on the final price. It’s important to distinguish between wholesale and retail prices.

Wholesale price is lower and can leave you with a lower margin, but also lower costs. When you sell directly to customers, you have more control over the final retail price and the margin you will earn, but you must account for extra risks, such as risk of stock, and costs, like marketing costs, location store costs, etc.

Wholesale Mark-Up

Wholesale price is the price you sell to your reseller. On top of covering the costs, this should also leave you with some profit, and the wholesale margin should cover everything. The wholesale margin is the difference between the landed cost and wholesale price.

Depending on the distribution channels, the margin will change. As a rule of thumb, the more the reseller buys, the cheaper is the price they’ll buy at, and the higher the cost will be for you.

Resellers like Zalando or Amazon usually guarantee high sales volumes, so they will demand a lower price and ask for a high discount. They might also ask you to take back unsold items or to contribute to the marketing budget. Smaller boutiques will only buy a selected amount of items and will pay a higher price.

It’s up to you to decide which distribution channel works best for your product, depending on the expected sales volume and positioning.

You might have an in-house sales team that deals with selling products to the reseller. In this case, you must consider their salary as part of the wholesale mark-up.

You can also use sales agents. They are not employees and work on commission (around 10% of the invoiced amount). The pros of sales agents are that they are a more flexible resource than an in-house team, they are quite experienced and have useful connections. Cons are that they can be quite expensive when it comes to big orders, and under EU laws, it is quite laborious to end collaboration with a sales agent.

Usually, companies use a mix of different sales resources. There is no right or wrong way of doing things: it depends on the individual case.

The wholesale margin should cover:

- Cost of inventory

- Impairment of inventories

- Sales discount

- Staff

- Rent

- Marketing

- Returns

- Claims

- Pick/Pack

- Free shipping

- New investments

For example, if your wholesale price is €25 and the landed cost is €10,69, the wholesale margin is €14,31 and your wholesale mark-up is 2,34.

Wholesale Margin = 25-10,69 = 14,31

Wholesale Mark-up = 25/10,69 = 2,34

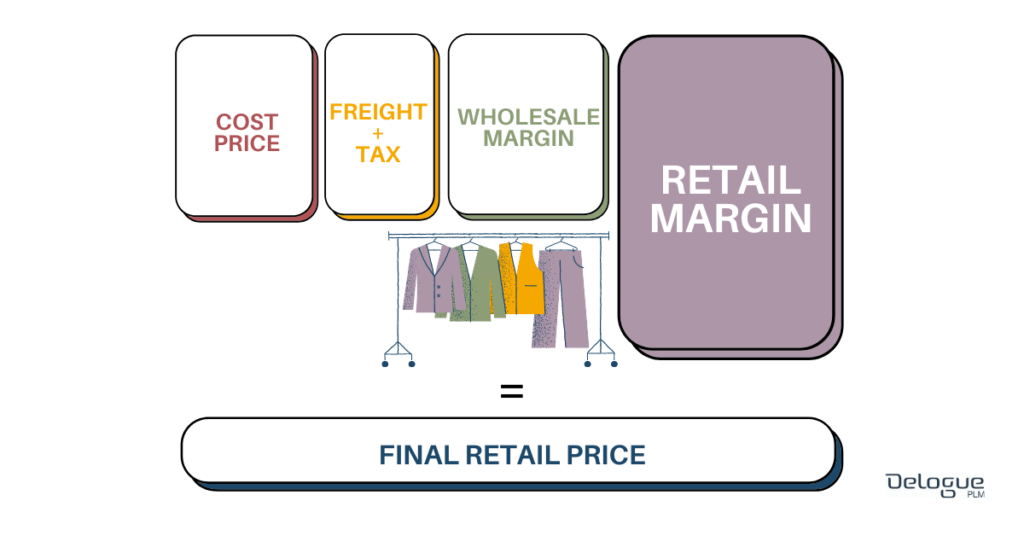

Retail Mark-Up

The final price at which the consumer buys your product also accounts for the retail markup, which is how much the reseller makes on the product.

For example, if the final retail price is €75 and the wholesale price is €25, the retail margin is €50 and retail mark-up is 3.

Retail Margin = 75-25 = 50

Retail Mark-up = 75/25 = 3

The risk of using Excel

As you can see from this guide, calculating garment costing and coming up with a pricing strategy can be complicated. Many use Excel for this, with the risk of minor human errors like using the wrong currencies or overwriting formulas. These mistakes might be small, but they will cost you big!

Using a PLM software can help you keep track of the costs as they develop, to make sure everything is under control and constantly updated, and to avoid errors and mistakes.

Find out more about PLMs and why they're essential for apparel brands.

Garment Pricing Strategy

Now that you’re an expert, it’s time to think about how to calculate the different parts of your equation. You can decide the price first and have a top-down approach, or start with the cost, with a bottom-up approach.

Target margin

Having a target margin in mind instead is part of the pricing strategy, to ensure you are profiting from your business. A target margin is necessary to evaluate if a collection is viable and deserves your time and money.

Your target margin can be expressed both as a ratio (a mark-up) or a percentage (gross margin).

Gross margin = ((Mark-up - 1)/Mark-up) x 100%

Top-down pricing strategy

With the top-down approach you make your calculations based on the target price. By having a target margin and a target sales price, you’ll be able to calculate the target cost.

A top-down pricing strategy is used mostly by big companies. This is because:

- They have a price level defined through years of experience

- They place high volume orders so they can negotiate a good price point with their distributors and suppliers

- They often own distribution channels, which makes it easier to control the final price

Bottom-up pricing strategy

A bottom-up approach starts with the cost. Knowing how expensive it is to produce a garment and what the target mark-up is, you can calculate a target price.

A bottom-up pricing strategy is useful when:

- You don’t have a lot of bargaining power with suppliers, so you have to accept their first cost price

- You cannot accurately estimate the ideal price for your customers

- Your customers are not price sensitive

And there we go, your ultimate guide to garment costing and pricing strategy!